Selling Your Website? Avoid this Revenue Type Buyers Won’t Pay For

My client Sadie used to chase revenue streams the way a golden retriever chases a thrown tennis ball. Breathless. Hopeful. Slightly unwell.

If someone so much as whispered “brand deal” near her inbox, she’d perk up like, “YES, PLEASE, PAY ME TO HOLD YOUR PROTEIN POWDER AND SMILE LIKE I’M IN A TOOTHPASTE COMMERCIAL.”

But then it came time to sell her business, and she learned the hard way what matters when you’re flipping websites: Not all income is created equal. Some income is sellable. Some income is… not.

As an affiliate partner of various brands and sponsored content, we may earn commission on qualifying purchases. Disclaimer | Advertise With Us

So when I’m flipping websites, I focus on only three revenue streams. Watch the video below to see which ones I recommend discussing on, and which ones I tell my clients to avoid at all costs.

Why I Avoid Brand Deals on Sites I’m Planning to Flip

I mostly ignore brand deals and sponsorships because when it’s time to sell, they often don’t help your valuation the way you think they will.

Let’s talk about why (and how to build the kind of income buyers actually pay for).

I’m sure in your creator career, at some point, there was a season where your website had: affiliate links, ads, a half-finished course, three random sponsored posts, and one “collab” that required 17 emails to earn $400.

Not to mention a brand contact who kept calling you “Hey girl!” like you’d survived a pyramid scheme cult together.

All that may make you feel like a business mogul. But that facade shrivels up real quickly once you want to sell your business. It’s something painfully clarifying:

Buyers don’t pay top dollar for revenue that depends on you staying you.

They want revenue that survives the transfer. They want income that’s repeatable, trackable, and defensible, even if the new owner is a completely different human with different vibes, different voice, and zero interest in photographing sunscreen on a rock at golden hour.

The Only 3 Revenue Streams I Focus On When Flipping Websites

Here’s what you need to know.

1) Affiliate Revenue (The “Set It and Forget It… Mostly” Stream)

Affiliate income is the sweetheart of website flipping for one big reason: It’s tied to content and intent, not your personality. A buyer can easily look at:

- which pages drive clicks

- which products convert

- what programs you use

- historical earnings by month

- EPC/RPM by page (depending on the setup)

- And they can improve it without needing your face, your email signature, or your relationship with any specific brand manager.

Why buyers like it: It scales with SEO and traffic, it’s relatively predictable when diversified, and it’s easy to document and transfer. Win, win, win!

My advice here is to focus on “evergreen” content that matches purchase intent. This can mean taking time to diversify programs (don’t marry one partner), and build content clusters so traffic compounds.

Affiliate marketing is like owning a vending machine in a busy hallway. You don’t need to personally greet every customer.

Related: Flipping websites vs flipping houses.

2) Display Ad Revenue (The “Boring, Beautiful” Stream)

Display ads are not glamorous. No one has ever posted a teary Instagram story like, “We hit $38.14 in Mediavine today and I just… believe in myself again.”

But buyers love display ads because they are highly trackable and directly tied to traffic. If traffic is stable and ad RPMs are within reasonable ranges, ad income becomes one of the cleanest revenue streams to underwrite.

Also, the numbers are easy to verify, and i’s not dependent on a single relationship.

Ad revenue is also “plug-and-play” with most ad platforms. It scales with traffic growth and content expansion.

3) Digital Products (The “You Own the Margin” Stream)

Digital products are powerful because they’re the opposite of “rented” income.

As much as I love affiliate marketing, an affiliate program can change its commission overnight. Or an ad network can slap you with a mysterious policy update because your headline used the word “best.”

With digital products, however, you control pricing, the offers, the positioning and the control customer journey.

Most importantly: A digital product is an asset. It can be transferred with the business.

Buyers can see the sales history, conversion rate, traffic-to-offer path, email funnel performance, the refund rate and the support load. All that is super valuation-friendly.

How to make a digital products business “sellable.”

- Document fulfillment and delivery

- Automate as much as possible

- Reduce your personal involvement (no “live every Tuesday forever” commitments!)

Digital products turn a site from a “content machine” into a sellable business. In case there was any confusion, buyers pay for businesses, and they don’t want to acquire another job.

Why I Don’t Chase Brand Deals and Sponsorships When Flipping Sites

Let’s talk about the shiny object everyone loves: Sponsorships and brand deals. They can be amazing for creators. They can be a big part of your income. They can absolutely be worth doing if you’re building a personal brand.

But if your goal is flipping websites…they’re often not worth building around.

Here’s why.

1) They’re Usually Not Transferable

Most sponsorship income is based on your personal credibility, your audience relationship, your face/voice/storytelling style, your delivery consistency, your direct connection with the brand…

A buyer can’t “buy” your rapport. So when a buyer looks at sponsored revenue, they often think: “Will this still exist when I own it?”

And the honest answer is frequently: “Maybe, but probably not at the same level.”

That uncertainty tanks valuations, fast.

2) They’re Inconsistent and Hard to Underwrite

Sponsorship revenue often comes in spikes. One big month, then nothing, then three deals at once, then ghost town for a year.

Buyers prefer revenue streams that show things like consistency, repeatability, and predictable inputs (traffic, conversions, email list, etc.)

Sponsorships are more like freelancing. Great money, less predictable.

3) Verification Is Messier

Affiliate and ad revenue live in dashboards. Digital product revenue lives in Stripe/Shopify/Thrivecart/etc. But sponsorships often live in email threads, DMs, and one-off contracts “we’ll pay net-60” chaos.

Even if it’s legit, it’s harder to prove cleanly and package neatly, from a potential buyer’s perspective. It’s adding more risk for them, and “more risk” is not a good look for website deals.

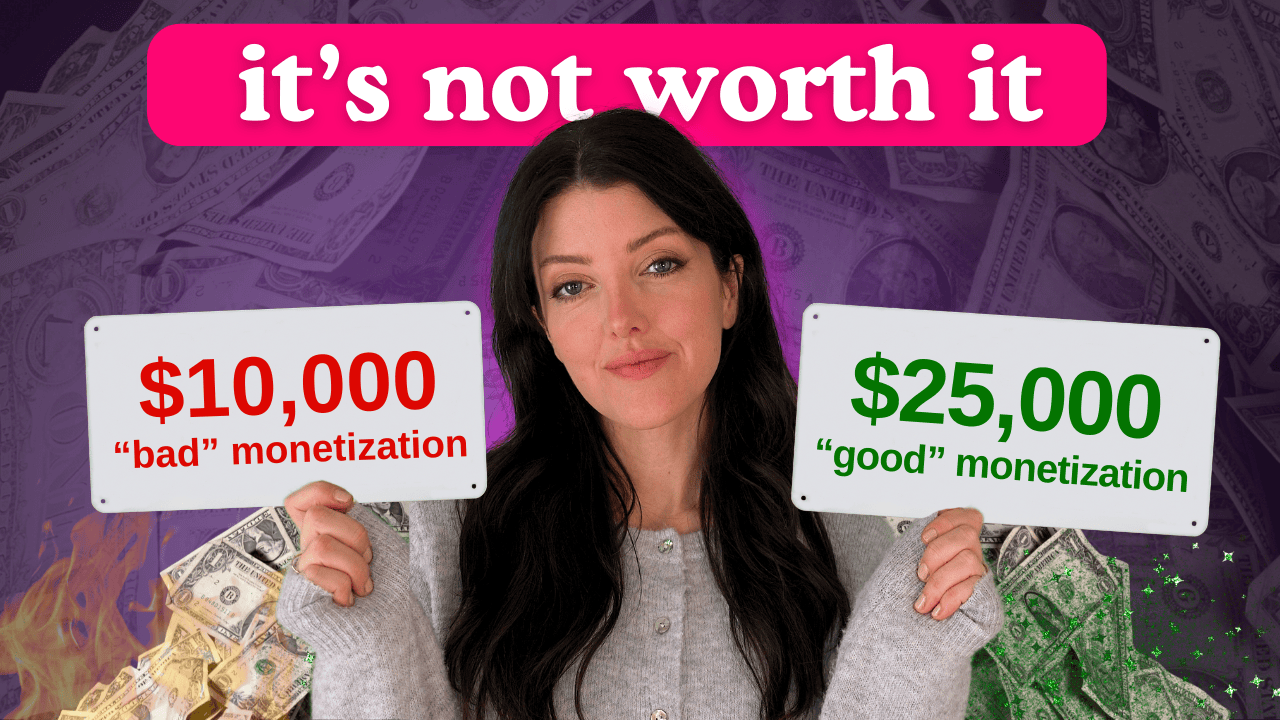

4) Valuation Is Usually Based on Profit Multiples, and Sponsorships Often Get Discounted

Most website sales use a multiple of average monthly net profit, often over the last 6–12+ months.

But buyers don’t treat all profit equally. In fact, sponsorship revenue often does not get factored into the valuation at all!

Revenue streams get “weighted” in a buyer’s mind based on risk. So if a chunk of your profit is sponsorship-based and they believe it will disappear post-sale, they’ll exclude it, discount it, or apply a lower multiple overall because the business is riskier.

Translation: You did a lot of work for income that doesn’t increase your exit value. And that is personally offensive. 😭

To avoid these mistakes, read Website Flipping Codes:

What This Means When You’re Building a Business to Sell

When you’re flipping websites, your goal isn’t just “make money.” It’s: Make money in a way a buyer will pay for.

That’s why I only focus on:

- Affiliate because it monetizes intent without needing me

- Digital products because they are owned asset with high margins

- Display ads: clean, verifiable, traffic-based income

Then, I treat sponsorships like dessert. Fun, optional, not the foundation of dinner.

Quick Cheat Sheet:

“Sellable” vs “Not As Sellable” Income.

High valuation energy:

Lower valuation energy

Conclusion

Once I stopped asking, “How can I earn more this month?” and started asking, “How can I build income a buyer will trust?” my flips got cleaner, faster, and more profitable.

Before you go, there’s a YouTube video where I share more tips to help you sell your websites at the top of its valuation. Scroll up to see it at the top of this page.