Due Diligence for Digital Real Estate: Website Buying Checklist

No shame, but you might have a personality flaw that is both charming and financially dangerous: you can convince yourself that something is “basically fine” if the screenshot looks pretty.

A website with a clean logo, a cute homepage, and a traffic chart that goes up and to the right? Your brain immediately goes, “This is my child now.” And that’s exactly how people buy digital real estate duds.

Because here’s the truth no one puts on the glossy listing page: a website can look healthy and still be quietly held together by duct tape, luck, and a single keyword that’s one Google update away from vanishing.

As an affiliate partner of various brands and sponsored content, we may earn commission on qualifying purchases. Disclaimer | Advertise With Us

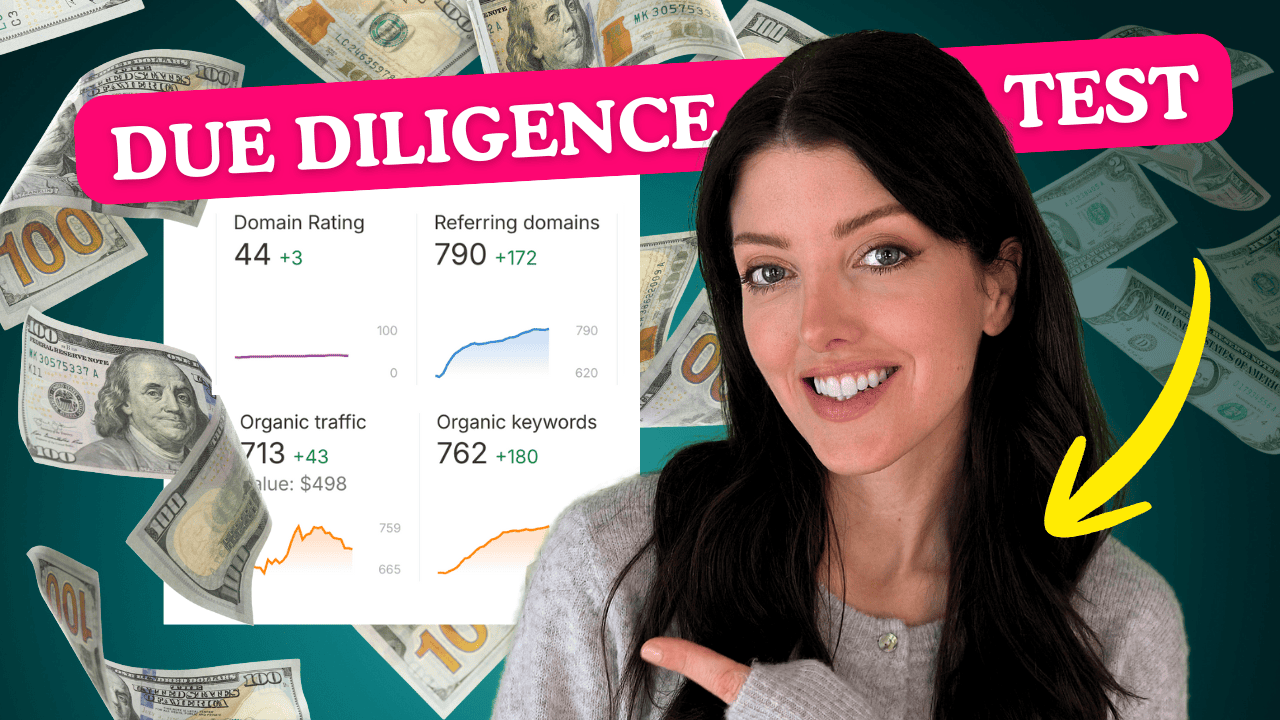

That’s why due diligence isn’t optional. And in the video below, I’m going to give you the due diligence framework I use to avoid duds, plus the exact checklist categories you need to review before you buy anything.

Reading Listings Like an Investor

I’m in “just one more listing” mode multiple times a week. This is the digital equivalent of wandering Zillow at night and whispering, “We could make that work.”

The listing is gorgeous. The seller sounds confident. The numbers look… very confident.

My internal monologue is already picking paint colors for the metaphorical kitchen.

Then I do what I always do now: I slow down, pull out my due diligence checklist, and start asking the boring questions.

And within minutes, the vibe shifts. Not dramatically. Not like a horror movie jump-scare. More like that quiet, creeping realization when you bite into a brownie and taste… tuna.

That’s the difference between buying digital real estate like a hobby and buying it like an investor.

Get a copy of the exact due diligence sheet I use every time. It includes 90+ important questions to run through before you EVER send a payment to a seller.

What “Due Diligence” Actually Means in Website Buying

Due diligence is simply the process of verifying that:

- The website is real

- The revenue is real

- The traffic is real

- The operations are real

- The risks are visible and acceptable

- The asset will still function after you own it

As a buyer, you’re buying traffic sources, monetization systems, content performance, operational processes, and the stability of the whole machine.

Yet, if any one of those pieces is held together by optimism alone, you don’t have an asset. You have a very expensive lesson.

The Two Reasons Most People Buy a Bad Site

1) They fall in love with the story. The seller’s story. The niche. The “potential.” The aesthetic. But in digital real estate, vibes are not a business model.

2) They skip the boring parts. They don’t verify traffic. They don’t verify revenue. They don’t look for concentration risk. They don’t test how fragile the asset is.

And then they act surprised when the income drops the second the deal closes. (Respectfully, the website didn’t betray you. You just didn’t interview it properly.)

Due Diligence for Digital Real Estate: The Website Buying Checklist Framework

If you’re even thinking about buying a website, do yourself a favor: Don’t buy based on screenshots. Don’t buy based on hype. Don’t buy based on “it feels like a good one.”

Buy based on due diligence.

I made a full YouTube video called: “Due Diligence for Digital Real Estate: Website Buying Checklist to Avoid Duds.”

In it, I walk through: the exact checklist I use what to verify (and how) the red flags that make me walk away fast and the “looks good but isn’t” traps that catch smart people all the time If you want the real tips, the thresholds, and the step-by-step process, scroll up and watch the video.

Because I would rather you spend 20 minutes doing due diligence than spend 20 months trying to revive a dud you overpaid for. And I say that with love. And mild trauma.

Read this next: How I Get Organic Traffic Without Google, Social Media, or Daily Posting.